The U.S. hotel industry neared the 50% occupancy mark, rising to 49.7% in the week ending 29 January 2022. The gain came mainly through leisure travel, which is beginning to reemerge after a post-holiday hibernation, with weekend occupancy increasing 3.5 percentage points week on week to 56.6%. Weekday occupancy was unchanged from the previous period, remaining at 46.9%.

The U.S. hotel industry neared the 50% occupancy mark, rising to 49.7% in the week ending 29 January 2022. The gain came mainly through leisure travel, which is beginning to reemerge after a post-holiday hibernation, with weekend occupancy increasing 3.5 percentage points week on week to 56.6%. Weekday occupancy was unchanged from the previous period, remaining at 46.9%.

Somewhat more encouraging, the Top 25 Markets saw occupancy advance a full percentage point to 50.5%, which was that group’s first time above 50% in four weeks. However, like the national average, the growth came mostly from weekend occupancy, which climbed to 58.3% as weekday occupancy fell. Shoulder days (Sunday & Thursday) also contributed to the Top 25’s occupancy growth and was up nationally.

For a seventh consecutive week, the Florida Keys led the nation in occupancy (83%) with Florida markets also again claiming seven of the top 10 highest occupancy levels in the country. Of the 13 Florida markets, only two were below 60% for the week: Orlando and the Florida Panhandle. The former is enduring ongoing weakness in groups, and the latter in a post-holiday lull. Overall, statewide occupancy in Florida was just below 65% for the week, behind Arizona, which was a half percentage point higher.

Gatlinburg/Pigeon Forge, TN had the weakest occupancy of any market this week and has been at or near the bottom for the past three weeks, alongside Myrtle Beach. Fifty-seven percent of the 166 STR-defined markets reported occupancy below 50% for the week. A week ago, 64% of markets were below the 50% level with a similar percentage in the week before that. Only 13% of markets had weekly occupancy at or above 60%, a similar percentage as in the fortnight.

Central Business Districts (CBDs) in the Top 25 Markets continued to suffer as occupancy remained weak at 39.3%, up 0.5 percentage points week on week. The Miami and Tampa CBDs were the clear winners with occupancy above 70%, although Miami gained occupancy week on week and Tampa lost ground. This was the first week with occupancy above 70% in the Miami CBD since New Year’s Eve week, while the Tampa CBD has been above that level for the past three weeks. Four CBD submarkets (Philadelphia, Washington, DC, Chicago, and Minneapolis) were firmly in the throes of depression with occupancy below 30%. All those CBDs except Washington DC have been below that occupancy level for the past four weeks. Washington DC barely surpassed 30% last week and the week prior. Surprisingly, average daily rate (ADR) for CBDs was up 4.9% week on week, driven by double-digit growth in Atlanta, Denver, St. Louis, and Washington DC.

Large hotels (300+ rooms) also saw occupancy move upwards in the week to 42%, but those in urban locations remained in the mid-30% for a third consecutive week. Large urban hotels in five submarkets (with at least four large hotels) topped 50% in the week, led by those in the Tampa CBD (75%). For a fourth week, airport hotels had the highest occupancy of any location type followed by resorts. Resort occupancy has surpassed 50% over the past two weeks and has gained nearly two percentage points in each of the past two weeks, confirming that leisure travel is beginning its return.

For a seventh consecutive week, the Florida Keys led the nation in occupancy (83%) with Florida markets also again claiming seven of the top 10 highest occupancy levels in the country. Of the 13 Florida markets, only two were below 60% for the week: Orlando and the Florida Panhandle. The former is enduring ongoing weakness in groups, and the latter in a post-holiday lull. Overall, statewide occupancy in Florida was just below 65% for the week, behind Arizona, which was a half percentage point higher.

Gatlinburg/Pigeon Forge, TN had the weakest occupancy of any market this week and has been at or near the bottom for the past three weeks, alongside Myrtle Beach. Fifty-seven percent of the 166 STR-defined markets reported occupancy below 50% for the week. A week ago, 64% of markets were below the 50% level with a similar percentage in the week before that. Only 13% of markets had weekly occupancy at or above 60%, a similar percentage as in the fortnight.

Central Business Districts (CBDs) in the Top 25 Markets continued to suffer as occupancy remained weak at 39.3%, up 0.5 percentage points week on week. The Miami and Tampa CBDs were the clear winners with occupancy above 70%, although Miami gained occupancy week on week and Tampa lost ground. This was the first week with occupancy above 70% in the Miami CBD since New Year’s Eve week, while the Tampa CBD has been above that level for the past three weeks. Four CBD submarkets (Philadelphia, Washington, DC, Chicago, and Minneapolis) were firmly in the throes of depression with occupancy below 30%. All those CBDs except Washington DC have been below that occupancy level for the past four weeks. Washington DC barely surpassed 30% last week and the week prior. Surprisingly, average daily rate (ADR) for CBDs was up 4.9% week on week, driven by double-digit growth in Atlanta, Denver, St. Louis, and Washington DC.

Large hotels (300+ rooms) also saw occupancy move upwards in the week to 42%, but those in urban locations remained in the mid-30% for a third consecutive week. Large urban hotels in five submarkets (with at least four large hotels) topped 50% in the week, led by those in the Tampa CBD (75%). For a fourth week, airport hotels had the highest occupancy of any location type followed by resorts. Resort occupancy has surpassed 50% over the past two weeks and has gained nearly two percentage points in each of the past two weeks, confirming that leisure travel is beginning its return.

Outside of the U.S.

Occupancy outside of the U.S. fell for a fourth straight week to 37.5% with ADR rising 6.8%, the first such increase of the past four weeks. Barbados had the week’s highest occupancy (78%) followed by Curacao (72%) and the United Arab Emirates (72%). Morocco, saddled with travel restrictions, again had the world’s lowest weekly occupancy (12%). Among the top 10 countries based on supply, occupancy ranged from 54% in the U.K. to 28% in Germany. Indonesia, China, and Japan were the only countries to see demand declines in the week. The U.K. saw the largest weekly gain of the top 10, up nearly five percentage points.

Occupancy in Canada increased for a third consecutive week, up 2.5 percentage points to 35%. The truckers’ protests in Ottawa greatly lifted occupancy over the weekend. Prior to this weekend, Ottawa’s weekend occupancy was in the low 20% range. This past weekend, that occupancy zoomed to 75%, the second highest weekend occupancy in the country behind the resort destination of Whistler.

European markets continued to see occupancy recovery, including Dusseldorf, Rome, Lisbon, and Amsterdam, all up at least three percentage points week on week. Paris ADR grew 13% week-over-week with ADR 30% higher than what it was in 2019 due to Haute Couture Week.

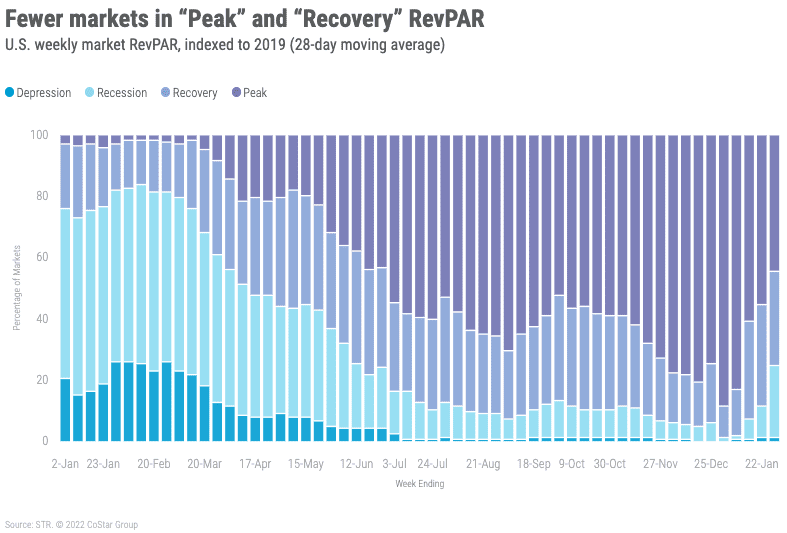

As we have seen over many weeks, most global markets remain mired in “depression” (RevPAR indexed to 2019 below 50). This week, 43% of non-U.S. markets were in that category, up from 32% a week ago. Another 35% were in “recession” (RevPAR indexed to 2019 between 50 and 80).

Big Picture

This week’s results give us further confidence that the worse of the Omicron and post-holiday lull is behind us. After hitting a 33-week low, TSA security screenings trended upward this past week, indexing at 76% of 2019’s level. Demand is beginning to increase, and ADR remained solid. Airlines and other travel-related industries are also reporting booking gains for the the weeks ahead, with better growth during the Presidents’ Day holiday. With two days left to process in January, we are encouraged that the month remained mostly aligned with our forecast. Demand is coming in a touch weaker but ADR stronger. The remainder of the year is expected to be much better with a strong leisure season and increasing business and group travel.