![]() Though the materialization of new coronavirus strains vex, it turns out, the more thrown our way, the better we now appear to cope.

Though the materialization of new coronavirus strains vex, it turns out, the more thrown our way, the better we now appear to cope.

Just as the world was rounding the corner on the Delta variant, along came Omicron—a rowdy interloper arriving to a party all hoped was winding down. And though the intrusion was noisy at first, Omicron could potentially be more insipid than insidious.

Despite our best efforts, there is an assumption that COVID will become an endemic disease, meaning it’s here in perpetuity, like the flu. That means one thing: better get used to it. If it’s Omicron one day, it could be Upsilon next.

For the hotel industry, that means rolling with the punches—hard or soft. The dark days of 2020 are—touch wood—never coming back and as 2021 comes to a close, the year ahead appears brighter, if not bumpy.

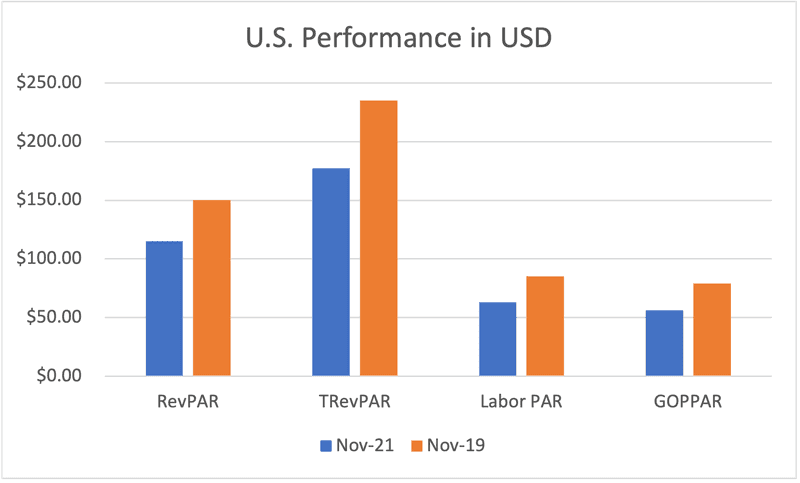

November data revealed the unevenness. Though the pandemic continues to impact travel, much of the trends in the U.S. in the month were seasonal in nature. A typical spike in profit in October, normally gives way to a drop off in November. Gross operating profit per available room came in at $55.68, which was a large uptick over the same month a year ago, when GOPPAR was still in negative territory. As it is, it’s still down 29.4% against November 2019.

One of the more propitious notes in the month was the continued willingness of hoteliers to hold and even drive rate. ADR in the month was $7 higher than at the same time in 2019 after being well down in 2020. This helped drive both RevPAR and TRevPAR, which were both up triple digits over 2020, though still down considerably versus 2019.

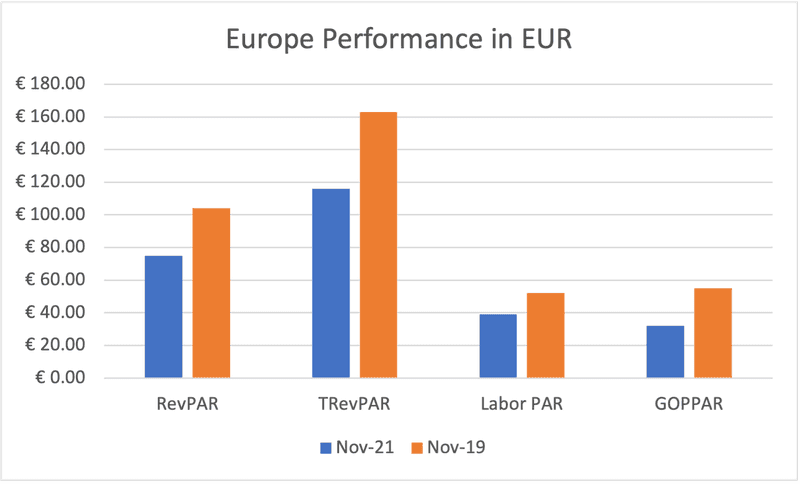

After steady incremental growth in Europe since April, November took a turn downward as GOPPAR dropped back to €32.59, which though well above the 2020 level was still 41% down versus November 2019.

Like the U.S., Europe has been able to retain rate, which was a full €10 higher than in 2019.

On the expense side, payroll remained €12 down versus 2019 on a per-available-room basis, helping lead to a flow-through of close to 50%.

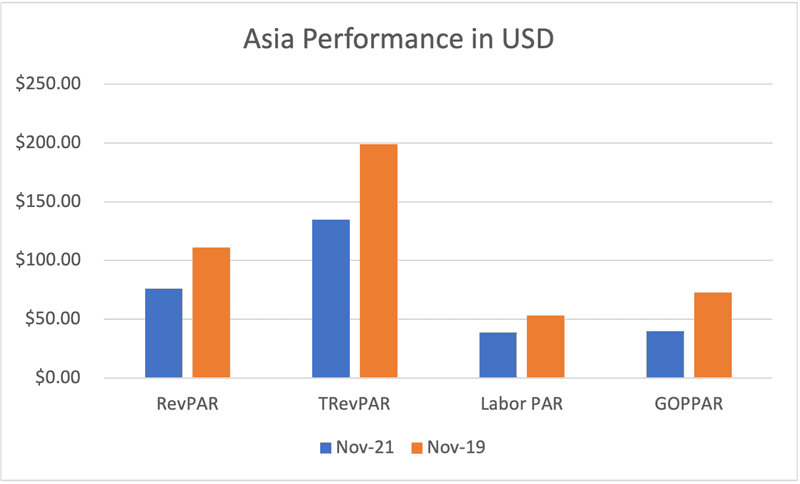

Numbers remained wobbly across Asia in November. China is a curious case: It’s a region where its backend 2020 numbers outperformed 2021. After performance took a nosedive in August due to an outbreak, it’s struggled to get back up. ADR remained above 2019 levels, but occupancy remained below 50%, leading to RevPAR of $41, which was 28% lower than at the same time in 2020. Total revenue similarly was down 25% year-over-year.

The drop in revenue, despite a still lower cost base, led to GOPPAR of $11, which was 64% lower than November 2020 and 75% lower than in November 2019.

Dubai continued to flourish as Expo 2020 rolled on. Revenue was up on the back of strong occupancy (86%) and ADR ($264), leading to RevPAR and TRevPAR up over the same time in 2019, 41% and 21%, respectively. The bump in revenue, combined with a lower cost base, which included payroll that was $11 lower on a per-available-room basis compared to the same time in 2019, led to GOPPAR of $178.46, which was a gaping 522% higher than at the same time in 2022 and 54% higher than November 2019.

First published on HotStats