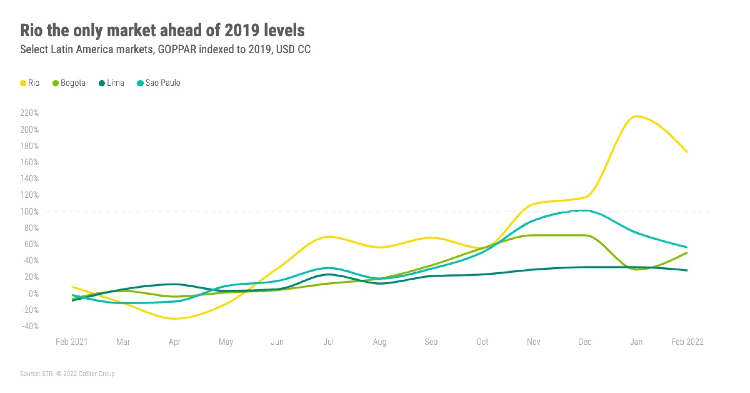

Key hotel markets in South America are still struggling to regain profitability due to inflation, pandemic-driven gaps in travel, and lessened impact from events, according to STR‘s February 2022 P&L data release.

Key hotel markets in South America are still struggling to regain profitability due to inflation, pandemic-driven gaps in travel, and lessened impact from events, according to STR‘s February 2022 P&L data release.

Building on its initial launch in the U.S., STR now features monthly P&L data reporting in four world regions: Europe, Middle East/Africa, Asia Pacific, and the Americas.

“Most of the markets in the region are only averaging around 36% of their pre-pandemic levels in gross operating profit per available room,” said Patricia Boo, STR’s area direction for Central/South America. “There were some improvements at the end of last year, but with inflation, and delays or cancellations of events, GOPPAR levels have once again fallen early in 2022.”

Rio de Janeiro is the only key market that has remained consistently above 2019 levels in GOPPAR. The market’s February GOPPAR was 172% of the pre-pandemic comparable, down from 216% in January. Lima was at just 28% of the 2019 comparable in February, but profit margins in the market are comparable with 2019 because of lower expenses.

“Rio maintained higher levels of profitability because hotel expenses in the market are down 19%,” Boo said. “That has allowed for more profitability even with lower demand and total revenue. Carnival being delayed is an example of the void left by large events, as the performance lift for hotels will likely be smaller when the event happens in April.”

Key profitability metrics:

TRevPAR – Total revenue per available room

GOPPAR – Gross operating profit per available room

EBITDA – Earnings before interest, income tax, depreciation, and amortization

LPAR – Total labor costs per available room